Gold Fever

The Small-cap Spin-off with Big Ambitions

General advice only – prepared for Wholesale/Sophisticated/Professional Investors. See full disclaimers below.

In January 1848, a carpenter named James Marshall was inspecting the sawmill he was building for Swiss emigrant John Sutter on the banks of the American River in California.

While checking the tailrace, Marshall noticed glimmers of something unusual in the water. He bent down, scooped a handful of gravel, and saw flecks of yellow that would change history.

He showed Sutter, who at first hoped to suppress the find. Sutter didn’t want to get rich quick. He dreamed of building an agricultural empire, with wheat fields and cattle pastures feeding a growing frontier. Gold, to him, was a distraction that could ruin everything.

But secrets don’t stay buried long.

Within weeks whispers spread. Workers abandoned their posts, prospectors appeared from across the state, and by the end of 1848 ships were docking in San Francisco carrying fortune hunters from across the Pacific.

By 1849, tens of thousands were streaming into the Sierra Nevada, tents and makeshift towns springing up overnight. The California Gold Rush was born. One of the greatest migrations of people and capital the world has ever seen.

Ironically, Sutter himself was one of the great losers.

His land was overrun, crops trampled, cattle stolen, and his vision of an agricultural dynasty shattered. He tried in vain to defend his holdings through the courts, but nothing could stop the tide.

While others struck it rich, Sutter died nearly penniless, remembered not as a successful land baron but as the man who stood atop one of the richest discoveries on earth without ever realising its worth.

It’s a dramatic tale of immense value hidden in plain sight. Ignored, resisted even, until the world finally woke up.

Our October stock pick holds an amazing gold find, that’s been ignored at the feet of a company chasing something entirely different.

But just like Sutter’s gold, the find couldn’t stay buried and ignored for long.

It’s time. A new Explosive Growth opportunity is taking shape…

This month, we’re going to dive into Ballard Mining (ASX:BM1).

Every so often a new ASX mineral explorer lists that stands out from the pack. One with more than the usual patch of dirt and nothing in the back pocket but a wish and a prayer.

Ballard stands out for this very reason.

Sharply.

There's a story here, and it's well worth tuning into. As it's got the potential to turn into one of the greats of the ASX gold mining scene.

It listed in July 2025 with a million ounces already in the bag, a fully permitted high-grade deposit, and heavyweight names on the register. The sort of launchpad most juniors can only dream about.

The spin-out came from Delta Lithium (ASX:DLI). Just a few short years ago, lithium was so hot they couldn't care less about a million ounces of gold under their feet.

How the mighty have fallen.

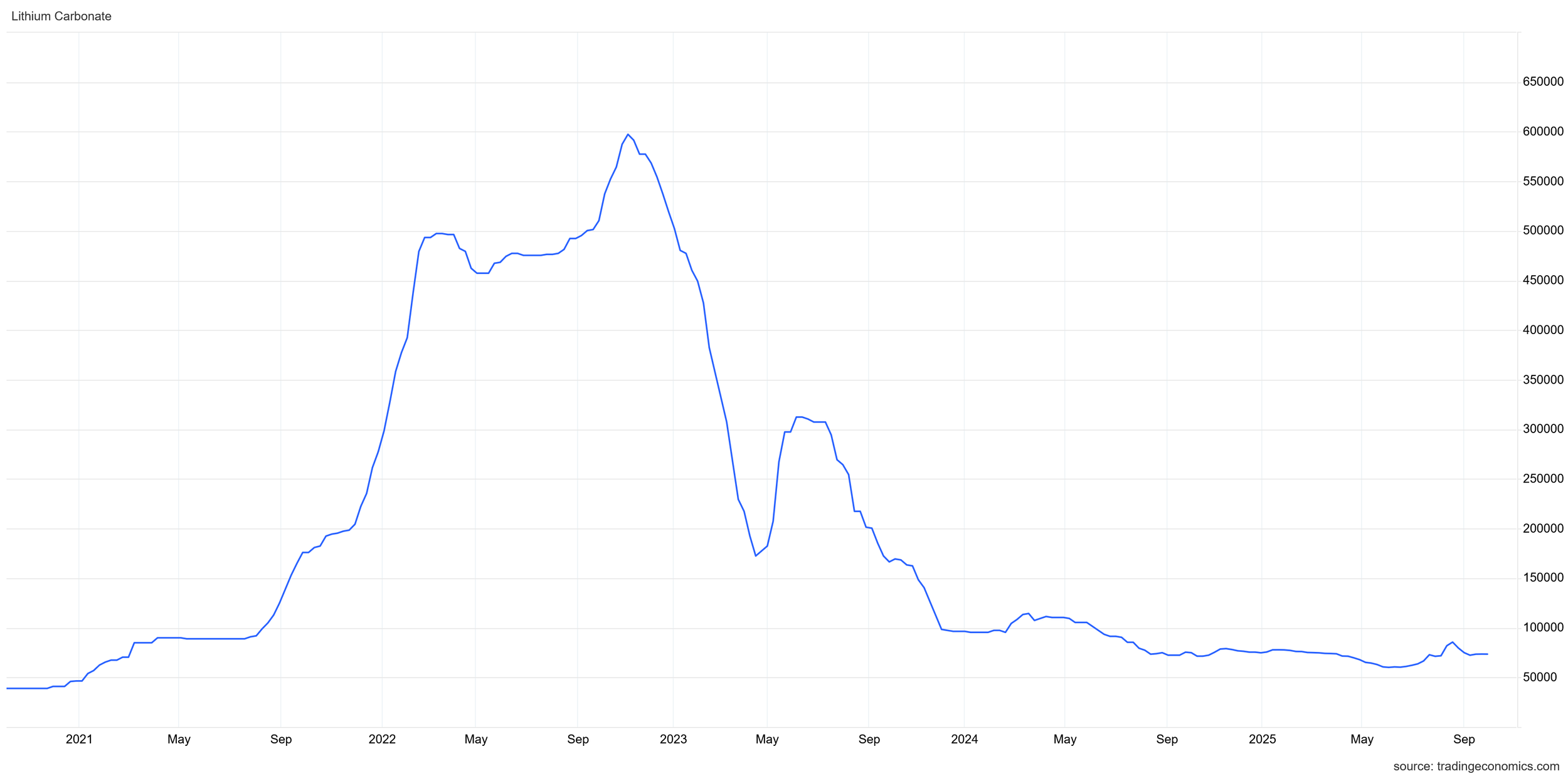

It's not 2022 anymore. Lithium's no longer riding high. Check the following lithium carbonate price chart.

Lithium Carbonate Pricing (Source: TradingEconomics)

The Lithium fall has been a wake-up call for more than one small cap miner on the realities of supply and demand.

So, this year, Delta took the prudent step to make something of their substantial gold reserves. They spun the gold assets out as their own company, forming Ballard.

Shareholders backed the move with 99.4% support in June 2025. Ballard listed a month later with 340 million shares on issue, $28 million net cash from the IPO, and a 1.1Moz JORC resource.

The backers are as strong as you’ll find in any tier one mining operation, let alone an unheard-of start-up.

Delta retained 46% under escrow. Hancock Prospecting holds 6.2%. Mineral Resources (ASX:MIN) sits on 5.6%. These are serious players with deep pockets and long-term views. Their involvement signals that Ballard's not just another junior punting for a hit.

The board brings pedigree too. Chair Simon Lill was at the helm of De Grey Mining during the Hemi discovery, one of the biggest gold finds in decades. Managing Director Paul Brennan's a mining engineer who's built plants and run underground mines.

CFO Tim Manners was part of the Ramelius Resources (ASX:RMS) growth phase, and non-executive Stuart Mathews has three decades of gold experience including senior roles with Gold Fields.

This isn't a team learning on the job.

The combination of major backers, experienced board, and a high-grade permitted deposit makes Ballard one of the most credible new gold floats in years. The challenge now is to turn Mt Ida from a one-million-ounce project into a multi-million-ounce district.

The Mt Ida Edge

At the heart of Ballard's Baldock, a 930 koz deposit grading 4.1g/t.

That grade matters. Most of the ASX gold developers are working with deposits closer to 1.5–2 g/t. There are some great projects with sub-1g/t grades which rely on cost-effective open pit mining and cheap and easy heap leaching.

Those projects rely on scale and bulk mining to scrape together margins.

Baldock’s grade means fat margins at today’s gold prices and resilience if prices fall. High grade means optionality. It gives the company flexibility in mine design and a buffer against volatility.

The ore's also free-milling and non-refractory. That sounds technical, but the meaning's that the gold can be extracted through a standard CIL process without expensive pre-treatment.

Metallurgy's where many juniors stumble. If you discover refractory ore, you suddenly need complex processing like pressure oxidation or flotation, which blows out capex. Free-milling ore's what every developer wants. It means lower risk, cheaper build, and better financeability.

Then there are the permits.

Ballard's now received Works Approval for a 2.0Mtpa processing plant and integrated tailings facility. This was the final approval needed, making Mt Ida fully permitted for both open pit and underground mining as well as processing.

That's a huge differentiator.

Many juniors spend years grinding through approvals. Ballard's already past that hurdle. The company's now able to focus entirely on drilling, reserves, and scale. Not red tape.

But Baldock's only the beginning.

The Mt Ida project spans 26km of strike across two fertile shear zones. The Baldock Thrust and the Ballard Fault. These are long, orogenic structures known to host multiple deposits in WA.

Baldock proves the system's fertile. The Ballard Fault's barely been touched, and already the first drilling there has delivered results. That result's Neptune. In September 2025, Ballard announced 23m at 1.8 g/t from just 21m depth. Wide, shallow, and open along strike. More importantly, the rocks look identical to Baldock.

This is the first sign that Mt Ida could host multiple deposits. Multi-deposit systems are valued very differently to single-mine stories. They offer district scale, longer mine lives, and the potential for hub-and-spoke processing.

Investors know this. And they love it. That’s why Neptune's a big deal.

Against the competition, Ballard stacks up well.

Ausgold (ASX:AUC), Astral (ASX:AAR), and Medallion Metals (ASX:MM8) have resources of similar size, but their grades are lower. Gorilla Gold (ASX:GG8) has high grades but lacks scale.

Ballard's got the grade, the permits, the cash, and now the first sign of district potential.

That’s the Mt Ida edge. High-grade ounces today, a fertile belt for tomorrow, and a structure that makes district-scale growth possible.

From Spin-out to Strike

Ballard’s short history's already full of action.

Within weeks of listing, rigs were on the ground at Baldock. Infill drilling returned thick, high-grade intercepts:

4m at 32 g/t

7m at 16.8 g/t

3m at 17.7 g/t

These hits are important because they confirm continuity.

It's one thing to have a resource model. It's another to show that the ore body holds together when you drill it tighter. Continuity's what converts resources into mineable reserves.

Then came Neptune.

That first 23m at 1.8 g/t hit was the catalyst investors wanted to see.

It showed the Ballard Fault's alive and mineralised. If Neptune builds, it becomes the second deposit in the Mt Ida system. That changes the whole narrative. Investors no longer look at Ballard as a one-trick pony. They start to value it as a potential district.

The drilling campaign's enormous.

Management's committed to 130km. About 80km is focused on Baldock, infill and extensions to underpin a maiden reserve by mid-2026. The other 50km is pure exploration across Neptune and 17 other targets along the corridor.

To put it simply, this much drilling is a catalyst machine. Every few weeks, new assays could hit the market. Each intercept carries the potential to move the stock. Constant news flow's a huge advantage. It reduces the binary feel of exploration and keeps investors engaged.

And this is how re-rates happen.

Markets tend to discount single-deposit juniors. They’re seen as vulnerable, with limited mine life and no optionality.

But once you prove multiple deposits, the whole picture changes. That’s when the big re-rate happens.

And Ballard isn’t working in isolation. The WA goldfields are alive again. Ballard slots neatly into this bigger narrative. The next wave of WA gold explorers proving their belts are far from mined out.

Crunching the Gold Math

The macro backdrop's a gift.

Comex gold futures priced in USD. Gold trades at $5,979/oz, record highs in Aussie terms.

Comex Gold Futures (Source: TradingView)

Those high prices matter because gold miners live on margins. At these levels, high-grade deposits like Baldock are money machines.

What makes Ballard even more attractive is that permitting risk is gone. With Works Approval granted in October 2025, Mt Ida's now fully permitted. Most peers still face years of environmental and heritage approvals.

Ballard can skip that headache. It's free to focus on drilling, reserves, and scale.

That clarity adds real value.

At 67 cents, Ballard trades at a market cap of $228m and an EV of $200m once you strip out cash. On a 1.1Moz resource, that’s $182/oz. Compare that to the peer average of $200/oz for high-grade peers, and Ballard looks undervalued. Especially when we factor in its grade, funding and permitting advantage.

The discount exists because it's early. Just listed, and the market is still waking up to the opportunity here. The upside comes as resources grow and reserves are defined. Of course with a massive drilling campaign underway, we expect that the 1.1Moz can grow into something bigger. That's a core part of our bet with Ballard, and of course one of the biggest risks.

Cash is straightforward. $28m from the IPO funds the 130,000m drill program plus overheads. At ~$200/m, drilling costs ~$26m. Add corporate and studies, and the IPO proceeds are spoken for. That buys 18–24 months of firepower. By then, Ballard plans to have a maiden reserve and a pipeline of discoveries. If the story builds, the next raise will be from a much higher base.

A back-of-envelope mine scenario for Baldock shows the leverage. Assume 7Mt at 4.1 g/t, giving 930koz contained. Apply 90% recovery, and you get ~837koz recovered. At 150koz per year, that’s six years of production. With an AISC of $1,600/oz and a gold price of $5,979/oz, margins are $4,379/oz. That’s ~$657m in annual operating cash flow, or ~$3.9b across the mine life. Even haircutting heavily for capex of $250m and contingencies, the numbers are very attractive.

Sensitivity tells the story. If gold falls to $4,500/oz, Baldock still generates ~$2b in operating cash flow. At $6,500/oz, it pushes past $4.5b. That’s why investors love high-grade deposits in strong gold markets. The torque's huge.

Running a discounted cash flow on those assumptions, using $657m in annual cash flow, a six-year mine life, and a 10% discount rate, gives an Net Present Value (NPV) of roughly $3b pre-tax. Even after taking out capex of $250m and a heavy 30% haircut for contingencies, the project still sits around a $1.9b NPV, nearly ten times Ballard’s current enterprise value of $200m.

The Path to Re-Rating

The drill program ensures constant catalysts. Every few weeks, new assays could hit the ASX. Infill at Baldock confirms continuity. Extensions along strike add ounces. Each result matters because it either builds the case for a strong maiden reserve or extends the resource base.

Neptune's the immediate wild card. The first hit was strong. Follow-up drilling will tell if it’s the start of another Baldock. Five more prospects north of Neptune have already been drilled, with assays pending. Each is a chance for another discovery.

That pipeline of targets means the stock will rarely be short of news.

And with permits now locked in, investors don’t have to worry about regulatory delays. The major catalysts from here are purely about discoveries, resource growth, and reserves. That makes the story cleaner and more investable.

The medium-term milestone is the maiden reserve in mid-2026.

Baldock Drilling Plan (Source: Ballard Mining Announcement 22nd September 2025)

That’s the trigger for many institutions to move in. Reserves mean the project’s real, not just conceptual. These near-term catalysts are exactly what feed into the longer-term re-rating pathway.

At $166/oz, Ballard's priced like a single-deposit developer. The upside comes as it proves it's more than that.

Double the resource base to 2Moz and EV/oz drops to ~$90. If the market then re-rates it to $200/oz, Ballard’s EV doubles to ~$400m. At 3Moz, the potential rises to ~$600m. That’s 2–3x upside without assuming anything heroic.

This is how the re-rates happen.

Bellevue Gold (ASX:BGL) re-rated from a $100m explorer to a $1.5b developer once Viago was joined by Deacon and other lodes. Capricorn Metals (ASX:CMM) steadily built Karlawinda into a hub-and-spoke system, with a steady re-rate along the way.

Pantoro Gold’s (ASX:PNR) Norseman restart story gained momentum when multiple lodes came into play.

De Grey went from $50m pre-Hemi to a $5b takeover once it proved Hemi was part of a district-scale system.

Ballard's chasing the same playbook. Baldock's the anchor. Neptune's the first sign of a second engine. The 26 km corridor offers many more shots. If even a handful of those 17 targets deliver, Mt Ida transforms from a single deposit into a district.

M&A's another lever. Hancock and Mineral Resources already on the register shows majors are circling. Natural buyers include Northern Star Resources (ASX:NST), Evolution Mining (ASX:EVN), and Regis Resources (ASX:RRL), all hungry for WA ounces. They typically wait until district scale's proven before moving.

Risks

Exploration's never guaranteed. Infill might fail to convert as smoothly as expected. Extensions might disappoint. Neptune may not scale. That’s the inherent risk in drilling. Exploration risk is the number one reason early-stage gold stories can unravel. Investors should always be prepared for holes that don't hit or for resources that don't grow as quickly as models suggest.

Funding's another. The IPO cash will cover this campaign, but development could require hundreds of millions. That means dilution or debt. Equity raisings are almost certain, and the timing and pricing of those raises matter. A weak market or souring sentiment toward gold explorers could make raising capital far more expensive than hoped. Even with strong backers like Hancock and Mineral Resources on the register, dilution is still a real risk for retail shareholders.

Execution's also a challenge. Even with permits, building a mine requires geotechnical work, metallurgy, and engineering. WA's got a history of cost blowouts and delays, from labour shortages to diesel costs to wet weather slowing construction. Execution risk is about far more than geology, it's about whether the team can deliver on time and on budget once shovels hit the ground.

And of course, the gold price. At $5,979/oz margins are extraordinary. But gold's volatile, and it's influenced by factors well outside Ballard's control, Fed/RBA policy shifts, currency moves, or a risk-off event that drains capital from commodities. A sharp correction would hit valuations and financing appetite hard.

For investors, the lesson's clear. Ballard's a speculative growth play. It belongs in the high-risk, high-reward bucket. The upside's asymmetric, but portfolio sizing's key. Position it appropriately in a portfolio so that the potential rewards outweigh the risks without creating portfolio damage if things don't go to plan.

In Summary

The Delta spin-off of Ballard Mining (ASX:BM1) is an interesting and compelling story. But is it a buy right now?

Sign up HERE to get your FREE copy of our full report, including our take on how to play Ballard Mining. You’ll also receive any future Explosive Growth stock recommendations straight to your inbox.

This publication has been prepared by The Markets IQ, a division of Vitti Capital Pty Ltd (ABN 13 670 030 145), which is a Corporate Authorised Representative (001306367) of Point Capital Group Pty Ltd (ABN 41 625 931 900), the holder of Australian Financial Services Licence 518031. This report is for general information only and does not take into account your objectives, financial situation, or needs. It is not personal financial advice or a recommendation to buy, hold, or sell any security. You should consider whether the information is appropriate in light of your circumstances and obtain professional advice before making any investment decision. This report is intended solely for wholesale, sophisticated, or professional investors within the meaning of the Corporations Act 2001 (Cth).

Any views, probabilities, valuations, technical levels, or forecasts expressed are strictly the opinions of the authors as at the date of publication, based on publicly available information and assumptions which may change without notice. They are illustrative only and not predictive of future outcomes. Past performance is not a reliable indicator of future performance.

Directors, staff, or clients of Vitti Capital may hold positions in Ballard Mining (ASX:BM1) or related securities at the time of publication. Such holdings may change without notice. Vitti Capital applies internal controls to manage potential conflicts of interest; however, readers should assume that conflicts may exist.

The analyst(s) responsible for preparing this research note certify that the views expressed in this report accurately reflect their personal views about Ballard Mining (ASX:BM1) and its securities. No part of their compensation is, or will be, directly or indirectly related to the specific recommendations or views expressed herein. The analyst(s) and/or their associates may hold an interest in Ballard Mining (ASX:BM1).