What is Inflation? How It Works, Why It Matters, and How to Beat It

Inflation.

It's a simple enough concept. Prices go up over time. Money buys less stuff.

Beneath that deceptively straightforward surface lurks a powerful beast. Something that can shake economies, shape political destinies, and send ripples through the lives of ordinary people everywhere.

Even Australia, in its brief history, has experienced massive swings in inflation and felt its harsh effects through different phases.

We’ll break down inflation, how it works, its effects on your daily life, and how you can beat inflation in 2025 and beyond.

What is Inflation? Understanding the Basics

At its core, inflation is the rate at which the general level of prices for goods and services rises, causing purchasing power to fall.

Your favourite flat white costs $5 today. Same coffee, same barista, same pretentious cafe vibe.

But next year?

$5.25.

Seems harmless enough. But stretch that over fuel, groceries, rent, insurance, school fees. Everything. And suddenly your $200 weekly shop looks more like $240.

In short, your money loses strength over time.

But the worst part is that inflation compounds. We’ve all heard about the magic of compounding returns.

A 5% compounding return on $100 look like this:

A 5% compounding return over 20 years

Just as compounding returns amplify investments, compounding inflation relentlessly erodes your spending power.

The forces that push and pull on inflation are myriad and complex. While our explanations of inflation are simple, the reality can be messy and harder to track. Cause and effect relationships can be obscured by shifting sands of geopolitics or take many years to play out.

To keep things simple, we can break down the key drivers of inflation into three key categories:

Demand-Pull Inflation:

When consumers have more money (thanks to wage hikes, tax cuts, or low interest rates), demand outstrips supply, and prices get tugged upwards.Cost-Push Inflation:

When production costs rise, like higher wages, spiking oil prices, or choked supply chains, businesses pass those costs onto consumers.Built-In Inflation:

Workers expect rising costs, demand higher wages, and businesses raise prices to match. So the expectation of inflation leads to inflation itself. A self-reinforcing cycle.

How Inflation is Measured (And Why It’s Flawed)

Australia’s main inflation gauge is the Consumer Price Index (CPI). It’s a ‘basket’ of everyday goods and services tracked by the Australian Bureau of Statistics (ABS).

There are 11 major categories, which are further broken down into 87 sub-categories, containing thousands of line items. The following image shows the major groupings and their percentage weightings from 2024.

Groups in the CPI basket and their weights in 2024 (Source: RBA)

But your personal inflation rate and weightings might look wildly different.

If you don't drive, petrol costs don't affect you. If you're renting in a hot market, housing inflation punches you hard.

CPI is a useful national guide. But for real-world individuals, it often misses the mark.

How Underlying Inflation Works

Beneath the headline CPI, economists track underlying inflation. Each central bank, think tank and rogue scholar may go about this in a slightly different way. However, the key idea is to hone in on the long-term signal of inflation and not the short-term noise of immediate events.

Trimmed Mean Inflation:

Removes the wildest price changes to focus on the middle 70% of movements.

Weighted Median Inflation:

Finds the price change in the middle when all price changes are ranked.

Underlying inflation strips away noise, helping central banks gauge sustained price pressures. This ensures they don’t overreact to aberrations and position appropriately for the long-term dominant signal.

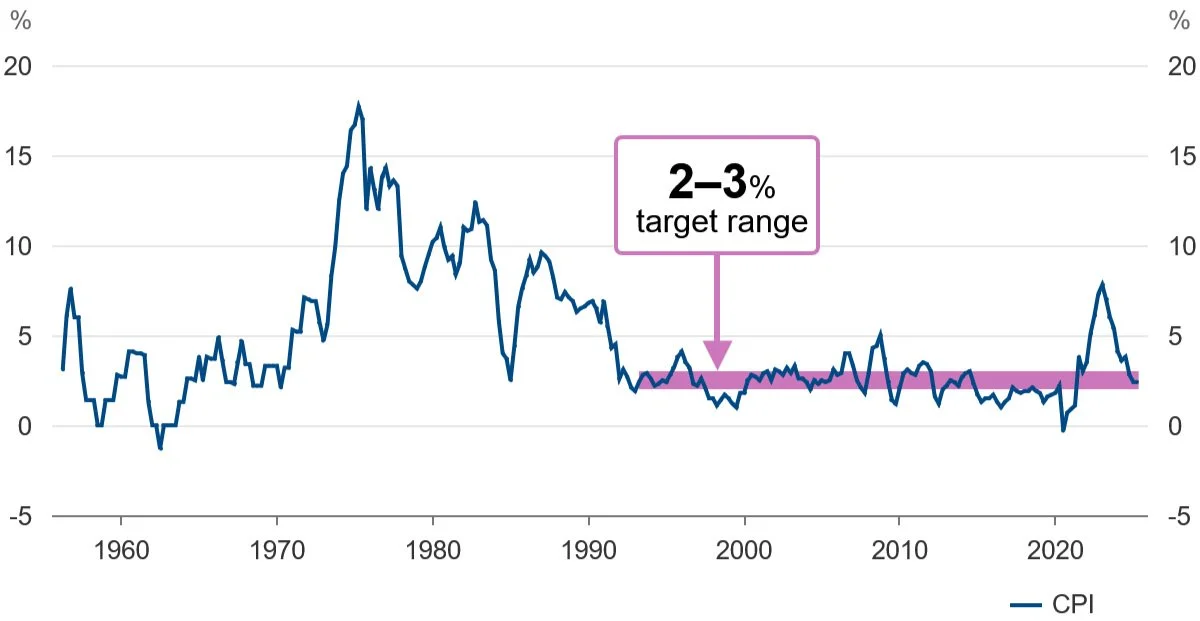

Australian Long-term Inflation (Source: RBA)

The Inflation Sweet Spot: Why 2–3% is the Goal

A little inflation is healthy. Central banks of developed countries, including the Reserve Bank of Australia (RBA), aim for around 2–3% inflation annually.

At this level:

Consumers are motivated to spend rather than hoard.

Businesses invest and hire.

Economies grow steadily.

But go beyond the sweet spot, and the risks multiply:

Hyperinflation (think Weimar Germany, Zimbabwe) destroys currency credibility and social stability. In the wake of covid lockdowns crippling supply chains, construction material prices have gone through the roof. This rapid inflation has caused many property developers and builders to go bankrupt as the cost side of fixed-price contracts has ballooned.

Deflation (falling prices) can stall growth completely, triggering recession and mass layoffs. When the prices of goods decrease over time, it incentivises consumers to stop spending and wait until things get cheaper. So, a natural cash hoarding effect occurs.

Effects of Inflation on Your Daily Life

Inflation doesn’t just happen in textbooks. It slaps you across the face every time you check your bank account:

Savings Erosion:

If inflation outpaces your savings interest rate, your money shrinks in real terms.Real Wage Decline:

If your paycheck doesn’t grow faster than inflation, your purchasing power bleeds away.Debt Pressure:

Mortgage repayments can balloon as central banks hike rates to control inflation.Bracket Creep:

Static tax brackets lead to taxes increasing as a portion of income as wages grow over time.

Inflation eats wealth like termites eat wood. At first, it’s invisible and barely noticed. An extra 20 cents for a cup of coffee, or $5 or a monthly gym membership. Over time, all those little changes accumulate and compound, leading to a big change.

Inflation and the Markets: Why Investors Obsess

Inflation is one of the most closely watched metrics in global financial markets, and for good reason. A surprise move in the inflation print can spark wild swings in interest rates, equity valuations, commodity prices, bond yields, and currency exchange rates. It’s not just a data point—it's the heartbeat of monetary policy.

When inflation rises unexpectedly, it sends shockwaves through markets:

Stocks: A moderate level of inflation can signal economic growth, which is generally positive for stocks. But high inflation is bad news. It leads to higher interest rates, which in turn reduce corporate profits and drag down valuations. Growth stocks, especially tech, are the most sensitive, while defensive sectors like utilities or consumer staples tend to hold up better.

Bonds: Rising inflation erodes the real value of future bond payments. Investors demand higher yields to compensate, which pushes bond prices down, particularly long-duration bonds. The result is brutal for bondholders when inflation expectations spike.

Gold and Commodities: Hard assets like gold, oil, and industrial metals are often seen as safe havens during inflationary periods. Gold doesn’t yield anything, but it retains value when fiat currencies are losing purchasing power. Commodities rally when demand stays strong and supply is tight, making them natural hedges.

Currencies: Inflation doesn’t just affect domestic markets—it hits exchange rates. If inflation in Australia runs hotter than in the US, for example, the Aussie dollar might weaken against the US dollar. Why? Because central banks may raise interest rates at different speeds. Investors chase higher real yields, shifting capital toward currencies with stronger purchasing power and better returns. Inflation differentials can significantly drive forex markets.

Inflation, Discount Rates, and Investment Valuations

One of the most critical, and often overlooked, ways inflation affects markets is through discount rates, a key ingredient in determining the present value of future cash flows.

When investors assess the value of an investment, they use a discount rate to calculate its Net Present Value (NPV). This discount rate typically includes the risk-free interest rate plus a risk premium, and it must factor in inflation. Here's the basic idea:

NPV Formula

Net Present Value (NPV) is calculated as:

NPV = Σ [Cash Flowₙ / (1 + r)ⁿ] from n = 1 to N

Where:

Σ is the ‘sum of’.

Cash Flowₙ refers to the cash flow in year n, with ‘ₙ’ simply indicating the year number.

r is the discount rate, which includes inflation expectations and the required rate of return.

n is the number of the year into the future, starting from 1 up to N (the final year).

This formula tells you to calculate the value of each year’s cash flow as it’s worth today, then add them all up. The result is the investment’s Net Present Value, a cornerstone of investment decision-making.

The formula could also be written out in long-form to show the steps of calculating each individual years returns in today’s value.

It would look like this:

NPV = (Cash Flow Year 1 / (1 + r)^1) + (Cash Flow Year 2 / (1 + r)^2) + ... + (Cash Flow Year n / (1 + r)^n)

Example: The Power of a 1% Change in Interest Rates

Assume an investment delivers cash flows that increase 20% per year, starting from $1,000 in Year 1, and continuing for 10 years.

At a 5% discount rate, the NPV = $22,409.51

At a 6% discount rate, the NPV = $21,063.71

A 1% increase in the discount rate results in a $1,345.80 drop in NPV.

That’s a 6% decrease.

This shows how sensitive long-term investments are to small changes in interest rates. Especially when future cash flows are large or growing.

How Central Banks Control Inflation

Central banks like the RBA and Federal Reserve are the inflation referees. Their job is to maintain price stability, typically by targeting inflation around 2–3%. Their primary weapon is Interest rates.

When inflation runs hot, central banks raise interest rates. This makes borrowing more expensive and encourages saving over spending. Mortgages, car loans and business credit become harder to obtain and to service.

With less cash sloshing around, demand cools, taking some of the heat out of price rises. But this tightening cycle can be slow to bite and difficult to fine-tune. The risk is overtightening and tipping the economy into recession.

On the flip side, when inflation is too low or when deflation threatens, central banks cut interest rates. Cheaper borrowing encourages consumers and businesses to spend and invest. That renewed demand can help lift prices and get inflation back on track. But when rates are already near zero, as they were post-GFC and during the COVID-19 pandemic, central banks turn to more experimental tools.

Among those tools is Quantitative Easing (QE), massive bond-buying programs that flood the financial system with liquidity. The idea is to lower long-term interest rates, increase asset prices, and create a wealth effect that stimulates spending. It worked in many cases, but also stoked asset bubbles and widened inequality.

There’s also yield curve control (YCC), used most famously by the Bank of Japan (BOJ). Under YCC, the central bank targets specific interest rates along the yield curve, committing to buy or sell government bonds in whatever quantity necessary to keep those rates stable. It's a bold way to anchor expectations and suppress borrowing costs.

And then there’s Operation Twist, used by the US Federal Reserve in 2011. Instead of expanding the size of its balance sheet, the Fed sold short-term Treasury bonds and bought long-term ones, flattening the yield curve and pushing down long-term rates to support the housing market and business investment.

The BOJ has arguably taken unorthodox policy further than any other central bank. In its bid to escape decades of deflation, the BOJ went beyond QE and YCC and became a major shareholder in Japanese equities through its purchases of ETFs. The idea was to spark inflation by pushing up asset values, boosting confidence, and nudging consumers and businesses to spend.

These tools are blunt, experimental, and controversial.

There are plenty of side effects. Asset bubbles, anyone? Capital misallocation. Then there’s the eventual tidal wave of inflation that can come all at once in an uncontrolled fashion.

Central banks have to walk a tightrope with every policy decision they make. Trying to balance inflation and employment without destroying growth in a volatile world economy.

Inflation in 2025: Why It's Different

Inflation in 2025 isn’t just another chapter in the economic textbook.

It’s a new, messy sequel to a once-in-a-century event. We’ve witnessed the most aggressive macroeconomic interventions in modern history with QE.

The effects of those policies were still being digested when the global economy rear-ended this COVID thing.

It was a collision of asset price bubbles and excessive liquidity, with fractured supply chains, labour reshuffles, energy volatility, and geopolitical flare-ups.

After the pandemic brought global economies to a standstill, governments and central banks responded with unprecedented stimulus.

Again!

Trillions of dollars were injected into households and businesses.

Sure, it provided much-needed relief and confidence. But there’s always a cost.

When markets reopened and lockdowns were lifted, the economy was red hot and ready to go.

The surge in consumer spending collided with supply chains that were still in disarray. Ports were clogged, factories short-staffed, and semiconductors in short supply.

Add to that persistent labour shortages as workers re-evaluated their lifestyles, retired early, or simply didn’t return to the workforce. The return to work phenomenon…never really happened.

Remote work looks here to stay, at least for many of us.

Then came energy shocks. First from the post-COVID demand rebound, and then exacerbated by the war in Ukraine.

Oil, gas, coal, and electricity prices spiked globally, pushing up input costs for businesses and heating bills for households.

Overlay that with geopolitical instability. US–China trade tensions, supply chain ‘decoupling’, Brexit aftershocks, and a multipolar reshaping of global power dynamics, and you have a volatile economic backdrop unlike anything seen in decades.

Initially, central banks labelled the spike in inflation as ‘transitory’.

By mid-2022, it was clear inflation wasn’t going away quietly. Interest rate rises came too slow.

Core inflation proved sticky. Services inflation accelerated. Rents, wages, and expectations all kept climbing. Central banks had to pivot hard. From ultra-dovish to the most aggressive tightening in decades.

This forced dramatic global shifts in monetary policy

From zero or negative interest rates to rapid-fire hikes, from balance sheet expansion to contraction, from ‘whatever it takes’ to ‘whatever it costs’.

It’s reshaping everything from mortgage rates to stock valuations to currency flows.

Inflation in 2025 isn’t just a cyclical blip. It’s the culmination of structural shifts that are still playing out. And the consequences for policy, portfolios, and household budgets are only just beginning to settle.

Where inflation goes from here, we can only guess. One thing is for sure. It won’t be boring.

Inflation Strategies: How to Beat Inflation

You can’t stop inflation. But you can outsmart it by shifting how you invest, spend, and earn.

Invest Wisely:

Inflation punishes cash.

To preserve and grow your wealth, you need assets that can keep pace or even benefit from inflationary environments.

Real estate: Property prices often rise with inflation, especially when supply is tight and demand stays firm. Rental income tends to increase as well, offering a built-in hedge.

Commodities: Hard assets like gold, oil, and industrial metals are classic inflation hedges. Gold maintains purchasing power, while commodities benefit from rising demand and constrained supply.

Inflation-linked bonds: These bonds (such as Treasury Inflation-Protected Securities, or TIPS, in the US) adjust both principal and interest payments with inflation. In Australia, indexed bonds issued by the Commonwealth can provide similar protection.

Equities with pricing power: Companies that can pass on higher costs to consumers, such as healthcare, utilities, and consumer staples, tend to perform better during inflationary periods.

Diversified portfolios: Spreading your investments across asset classes (stocks, bonds, property, commodities) reduces the risk that inflation will erode your entire portfolio.

Budget Strategically:

You don’t need to become a miser, but you do need to become methodical. Inflation hits unevenly. Some prices soar, others stay flat. This creates opportunities to spend smarter.

Prioritise fixed-rate debt: Lock in interest rates on mortgages or personal loans. Variable rates will eat you alive during tightening cycles.

Substitute smartly: If red meat becomes too expensive, shift to chicken. If electricity rates spike, look at efficiency upgrades.

Lock in service contracts: If you rely on services—whether childcare, trades, or subscriptions—negotiate longer terms at today’s prices.

Track spending: A simple budget spreadsheet or app can reveal where inflation is biting you hardest and where to cut fat.

Boost Your Income:

The best defence against rising costs? Earning more. If only it were that simple.

Negotiate for CPI-linked pay: Push for wage increases that track with inflation, especially if you're in a high-demand sector. Alternatively, you can use inflation as a justification for a pay rise. After all, it’s not really a pay rise, just adjusting your salary to current prices.

Start a side hustle: Whether it’s freelancing, tutoring, ecommerce, or delivery, extra income helps buffer inflation shocks.

Invest in skills: Learn high-demand digital or trade skills. AI, marketing, cloud computing, and hands-on trades are all commanding premium rates.

Waiting for inflation to ‘go away’ is like waiting for a bushfire to extinguish itself. The better move is to build firebreaks now. Insulate your finances, control what you can, and position yourself for strength no matter what the RBA or the Fed does next.

The Inflation Endgame: Why It Matters to Everyone

Inflation isn’t just some boring line on a central bank chart. It’s the financial weather system that surrounds us all, sometimes sunny, sometimes savage.

Left unchecked, it’s a wrecking ball. It corrodes your savings, sabotages your salary, inflates your mortgage, and destabilises nations.

But when harnessed and managed, it’s a growth engine. Fuel for innovation, wage increases, and productive risk-taking.

So what’s the endgame?

It’s not about predicting the next CPI print or trying to time rate cuts.

It’s about recognising that inflation never sleeps. It’s always out there, silently reshaping the value of your money, the structure of the economy, and the decisions you make every day.

Awareness is your best defence.

Preparation.

The ability to adapt when the ground shifts.

Because inflation doesn’t knock. It doesn’t RSVP. It shows up uninvited and starts rearranging your financial furniture.

So stay sharp. Invest smart. Think in real terms, not just nominal gains. Build assets that can weather the storm.

Most of all, don’t wait for someone else to solve it. Especially politicians. They are often the worst at understanding and reacting to inflation.

Inflation matters because money matters. Every dollar in your pocket matters. Understand inflation, and you don’t just survive, you thrive.

Master it, or get mastered.