The Gift of Sound

THE hearing tech nanocap changing how we listen

General advice only – prepared for Wholesale/Sophisticated/Professional Investors. See full disclaimers below.

Let’s do a thought experiment.

Imagine your eyesight’s starting to fade. You can still see fine at a distance, but now you’re holding books and your phone half a metre from your face just to make out the words. It’s the classic ‘old person’ move.

If a movie director wants to show someone’s getting older, they don’t need wrinkles or a walking stick, they just show them squinting at a menu and holding it away like it’s radioactive.

Now it’s happening to you. And you can’t help thinking you’re way too young for this nonsense.

So, you book an optometrist appointment. You walk in, explain your problem, and before you’ve even finished your sentence, the cashier slides that little white payment square across the counter. It’s blinking, smugly, not even telling you how much it’s about to take.

You hesitate. Maybe it’s that white square staring you down. Or maybe it’s the assumption that you’ll just tap and pay whatever they’ve dreamed up. So you decide to test the glasses first.

And when you do, everything becomes clear. Not visually, of course. The glasses are rubbish. Your vision’s maybe 5% better, and the dizziness hits instantly.

What’s clear is that you’re being sold junk.

‘Hey, what gives?’ you say. ‘I need glasses that actually fix my eyesight.’

‘Sorry, we only stock one kind of glasses,’ they shrug. ‘But don’t worry, everyone buys them.’

Obviously, that doesn’t happen anymore. Not since companies like American Optical and Zeiss made personalised lenses the norm.

Now imagine if the same thing happened, not with your eyes, but with your ears.

Because that’s exactly how it works.

Every time we buy headphones, we’re buying someone else’s prescription. Generic sound, one-size-fits-all. Our ears are as unique as our eyes, but we act like they’re not.

Sound is one of those things we take for granted. Until it’s gone. Hearing loss affects almost everyone as they age, yet we rarely think about what that means.

And just like wearing the wrong glasses can damage your sight, using headphones that blast sound not tuned to your hearing can cause long-term harm.

The data’s brutal.

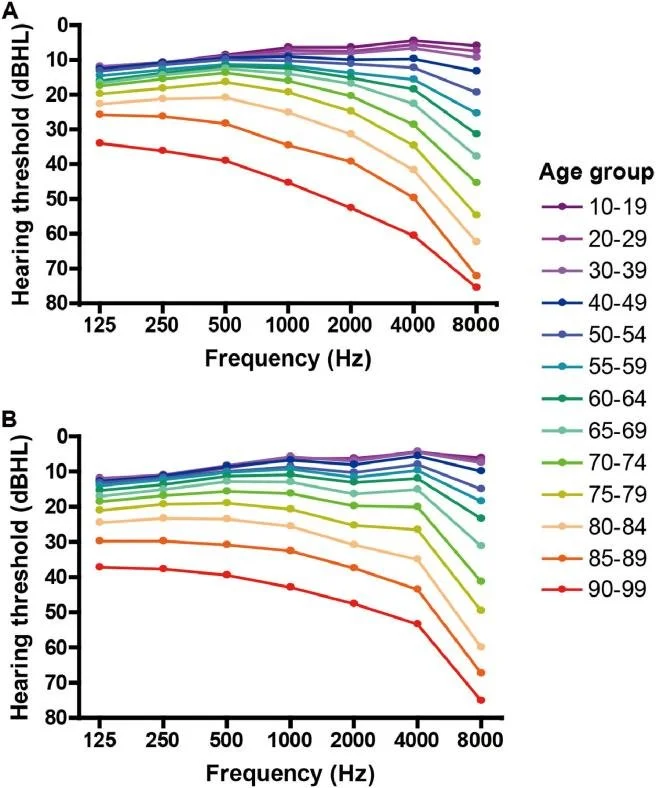

The following chart shows how hearing declines with age, across every frequency, for both men and women.

Hearing Loss By Age Group (Source: Wasano K et al., The Lancet Regional Health – Western Pacific, 2021.)

We gradually lose the ability to hear higher frequencies through our younger years, then it accelerates fast as we get older. The impact goes way beyond how loud the TV needs to be.

It hits relationships. Communication. Confidence. It isolates people, especially in old age, when social circles are already shrinking.

And as the world gets older, with falling birth rates and longer lifespans, hearing loss is becoming a major public health issue hiding in plain sound.

But this isn’t just an ‘old person’ problem. Hearing loss affects everyone, from tradies on worksites to teens with earbuds jammed in 24/7.

Everyone’s chasing the next AI chip, but few are listening to the next sensory revolution. Hearing is the one sense we’re letting slip, and that’s the disconnect worth paying attention to.

It’s time. A new Explosive Growth opportunity is taking shape…

This month, we’re diving into Audeara (ASX:AUA), a Brisbane-based hearing tech company innovator and manufacturer.

Its mission is to make how we listen personalised, just as Zeiss and American Optical did for sight.

Audeara designs, engineers, and sells personalised listening products for people with hearing challenges, and safe listening solutions for anyone who wants to protect their ears.

Its innovation is deceptively simple yet technically sharp. The idea began in a doctor’s head. A fix for a real problem. Not some marketing stunt to grab eyeballs (or eardrums).

Dr James Fielding saw how hearing loss creeps up on people.

Subtle. Slow. Unnoticed.

He wanted to address that, not just with hearing aids, but by changing how we listen altogether.

Audeara sits at the intersection of hearing health and consumer audio, a sector blending medical precision with everyday tech.

Think Apple, built by audiologists. With a market cap of just $5.75 million, the footprint is tiny, but the ambition is huge.

Co-founder and CTO Alex Afflick took the idea from prototype to production and now leads the charge into software and licensing.

Company insiders continue to buy shares on-market. A clear sign they believe in what they’re building. Together, they’re creating a movement toward personalised sound. A world where everyone hears life exactly as it’s meant to sound.

Founder-led businesses are a prized breed in the Investosphere.

The people who built the company are still steering the ship, and that’s a major confidence boost for investors.

Who would you trust more to grow Tesla? Elon Musk or a fresh face?

Musk wins hands down if you care about your investment.

Musk’s ownership aligns his incentives with shareholders. The same logic applies here. Founder-led companies often hold meaningful stakes, show deep conviction, and build for the long haul.

Audeara’s Personalised Hearing Tech

The global hearing aids market is huge and growing fast, expected to grow at ~6.23% every year to hit US$12 billion by 2030.

But traditional hearing aids come with baggage. They’re expensive, clinical, and still carry stigma. They’re built as medicine, not for lifestyle.

Meanwhile, consumer headphone giants churn out billions of units every year with zero regard for hearing health or individual differences.

Audeara saw the gap.

Millions of people with mild to moderate hearing loss who aren’t ready for hearing aids, and more who just want to protect what they’ve got while enjoying quality sound.

Add to that the huge pool of hearing aid users who still crave better entertainment experiences, and you’ve got an untapped frontier.

The secret sauce is its hearing-profile algorithm. That’s the tech that transforms ordinary headphones into a profound listening experience. It’s cutting edge entertainment and accessibility, all in one.

Through a quick app-based test, the system measures sensitivity across frequencies in each ear, building a kind of fingerprint for your hearing.

When that data syncs with Audeara’s hardware, the magic begins. The headphones automatically adjust output to match your personal hearing profile. If your left ear struggles with higher frequencies, as most of us do with age, Audeara boosts only those tones in that ear, delivering clarity without distortion.

It’s not just equalisation. It’s personalised sound therapy that makes music cleaner, speech sharper, and listening safer for long-term hearing health.

The tech even integrates with cochlear implants and hearing aids, widening the potential market significantly.

Only around 20% of people who need hearing aids actually use them. That leaves 80% searching for an accessible, stigma-free solution.

Audeara fits perfectly in that space. Affordable, prescription-free, and designed to look and feel like premium headphones.

While Bose, Sony, and Sennheiser make incredible gear, they’re built for the masses. Their accessibility tweaks are surface-level. None deliver Audeara’s degree of personalisation or clinical precision.

Audeara isn’t trying to outcompete them head-on.

It’s targeting a specific niche. People with hearing challenges. And now, it’s going a step further by embedding its tech inside other companies’ products through its AUA Technology division.

The Licensing Model Advantage

This is where the model shines. Instead of burning millions on marketing, Audeara licenses its hearing-profile algorithm to global brands that already own consumer distribution. That turns each new partnership into a high-margin revenue stream and moves the business closer to a scalable, software-like model.

The partnership with Zildjian is the perfect case study.

Musicians desperately need hearing-safe products, but developing that tech from scratch would take years. By partnering with Audeara, Zildjian gets instant access to proven hearing technology.

Audeara manufactures the product, Zildjian sells it, and both profit. Revenue flows from production orders and ongoing licensing fees with no ad spend required.

This model scales naturally. Each new partner opens a different industry. Music gear, consumer audio, pro sound systems, even automotive or telecom.

No new sales force needed, just smart licensing.

Clinico in Taiwan proved this works. The country’s largest hearing aid retailer co-branded Audeara earbuds, using their retail network to sell a premium hearing-healthy product.

More recently, Eastech (Eastern Asia Technology) joined to launch Audeara into the Chinese medical device market, again using local reach to scale global sales.

Growth Phase

Audeara’s been quietly tuning its sound for years. While many small-caps chase quick hype, this one spent time getting the fundamentals right, building tech, partnerships, and credibility before turning up the volume.

Going Public (2021–2022)

Audeara listed on the ASX in 2021 with a ~$20 million valuation. The IPO gave it fuel to scale manufacturing and build distribution.

Revenue that year was $1.1 million with a $1.25 million loss. By FY2022, sales nearly doubled to $2.07 million as the company locked in audiology partnerships across Australia.

The A-02 TV Bundle, a clever fix for the age-old ‘turn the TV down!’ household war, found traction fast.

The Expansion Phase (2023)

FY2023 was the inflection point. Revenue climbed 40%, distribution expanded, with products appearing in six countries.

Operating cash burn eased as the model began to hum.

Clinico, Taiwan’s largest audiology retailer, became a launchpad into Asia.

Partnerships with global heavyweights Amplifon, Demant, and WS Audiology validated credibility and expanded reach.

Then came the AUA Technology Division, a pivot toward licensing and white-label deals.

Recognition followed, with the Audeara Mobile Companion app winning a Good Design Award for simplicity and accessibility.

The Breakthrough (2024)

Phase Three turns validation into velocity.

If 2023 proved the concept, 2024 made it commercial. The $2.1 million purchase order from Avedis Zildjian, the 400-year-old cymbal titan, was the breakthrough moment.

It was Audeara’s first large-scale production order under its new licencing arm.

Suddenly, the stock had rhythm. Marketing ramped up and awards kept coming.

Asia followed fast.

Deals with Amazing Hearing Group in Singapore and Eastech Holding in Taiwan opened gateways to China’s vast medical device market.

Executing Deals (Late 2024–2025)

The launch of Audeara Buds, its first true wireless earbuds, expanded its lineup and tapped into the fast-growing portable audio segment.

Demand surged from both clinics and consumers.

Then Zildjian returned with a follow-up US$917,000 order, proving repeat demand. A new deal with Eyear System Inc. opened Japan, one of the world’s most advanced hearing markets.

Back home, a two-year supply contract with the world’s largest audiology chain locked in minimum annual orders of 2,500 units. Domestic sales climbed 115% year-on-year.

Audeara capped it off with another trophy, the 2025 Queensland Small Business Export Award.

Financials

Before diving into the numbers, it’s worth resetting expectations. Audeara isn’t a dividend-paying value stock. It’s a small, high-growth tech company still in its commercialisation phase.

Looking at it through Warren Buffett’s lens of steady cashflows, low debt, and predictable returns misses the point entirely.

The real question is whether this company is doing what great tech stories do best, converting years of R&D into real revenue, tightening unit economics, and pushing closer to profitability with each quarter.

Revenue Trajectory:

FY22: $2.1 million

FY23: $2.9 million (40% growth)

FY24: $3.2 million (10% growth)

FY25: $3.8 million (19% growth)

Revenue has climbed year in, year out, accelerating dramatically in late 2024 and through 2025 as major partnerships began delivering.

Loss Trajectory:

FY2022: Net loss $3.0 million

FY2023: Net loss $3.7 million

FY2024: Net loss $1.6 million

FY2025: Net loss $1.8 million

Yes, losses ticked back up in FY25, but this wasn’t a blowout. It was a conscious reinvestment, more R&D, bigger inventory, and preparation for scale. That’s the kind of burn you want to see at this stage, productive not reckless.

Q1FY26 Update

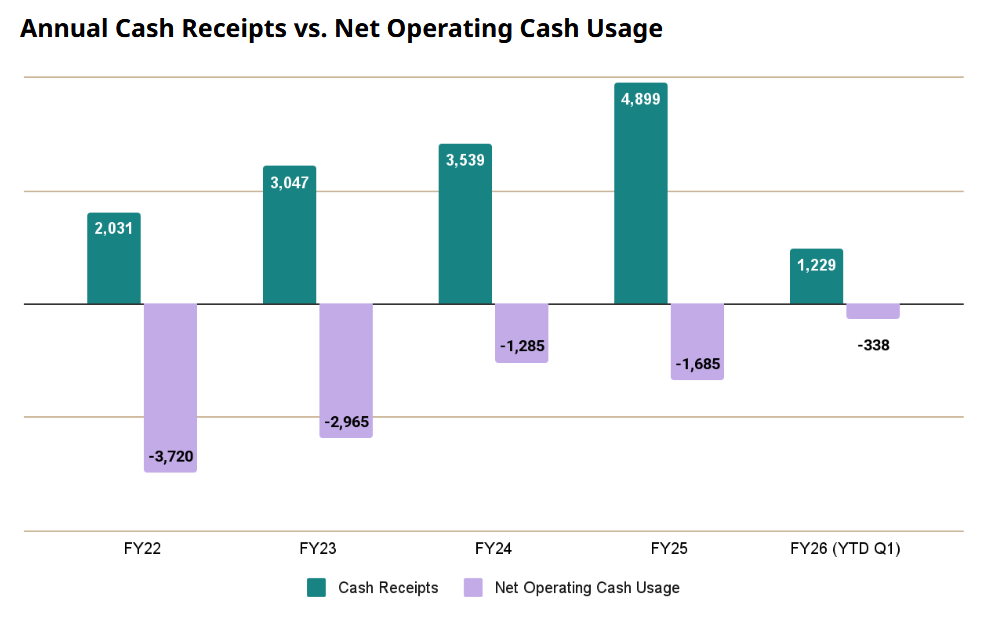

The September quarterly told a simple story, growth is accelerating but cash is tight.

Revenue hit $1.52 million, up 111% on the previous quarter. Cash stood at $1.21 million, after an operating outflow of $0.34 million.

Loans drawn total $1.1 million, and at the current burn rate, Audeara is funded through FY26 but not much beyond.

That’s why investors should expect some kind of raise in the next six months, whether through equity or debt. This isn’t alarming, it’s just the standard rhythm of scaling a small-cap tech manufacturer.

Cash is the biggest concern at the moment, and what investors will be most paying attention to.

Audeara Cash Receipts and Usage (Source: Audeara Q1FY26 Quarterly Activities Report)

Risks

No investment story is complete without an honest look at risk. Audeara has reduced much of its early uncertainty through proven technology and partnerships, but this is still a young, fast-moving company where execution matters. Here are the key risks to watch:

Cash Flow and Capital Risk

Audeara has $1.2 million in cash and burns roughly $338,000 per quarter, leaving limited runway. If orders delay or growth slows, it may need to raise $2–3 million within a year, which would be highly dilutive at its small market cap. Investors should expect a capital raise unless cash receipts accelerate quickly.Competition and Innovation Risk

Apple, Sony, Samsung, and Bose all have the resources to add personalised hearing to their products. If they make it standard, Audeara’s edge weakens fast. The shift toward licensing helps, but the company must secure big deals before giants crowd the space.Partnership and Key Account Risk

Zildjian’s two orders nearly match Audeara’s total FY2024 revenue, meaning concentration risk is high. If those orders dry up, or if quality issues emerge, the impact would be severe. Investors should track repeat business as proof of durability.Manufacturing and Supply Chain Risk

Hardware introduces cost, component, and quality control challenges. Audeara relies on Asia-Pacific manufacturing partners, exposing it to supply shocks and geopolitical tensions. Even one faulty production run could jeopardise hard-won relationships.Regulatory and Market Access Risk

Audeara sits between medical and consumer markets, facing shifting regulation and inconsistent product classification. Any change could slow sales or raise compliance costs, especially if audiologists prefer traditional hearing aids that pay better margins.

The Bottom Line

Cash remains the near-term risk, competition and partnership reliability the long-term tests. This is a high-risk, high-reward micro-cap that deserves small position sizes and close monitoring. The potential payoff is real, but so are the execution risks.

In Summary

The big question on investors’ minds is how quickly growing revenues will flow through to bottom line profitability.

The current growth of Scientific deal is a pivotal point in the Audeara (ASX:AUA) story.

Sign up HERE to access your free copy of our full report, including the outlook and our take on how to play Audeara.

Audeara (ASX:AUA) Daily Price Chart (Source: Tradingview)

This publication has been prepared by The Markets IQ, a division of Vitti Capital Pty Ltd (ABN 13 670 030 145), which is a Corporate Authorised Representative (001306367) of Point Capital Group Pty Ltd (ABN 41 625 931 900), the holder of Australian Financial Services Licence 518031. This report is for general information only and does not take into account your objectives, financial situation, or needs. It is not personal financial advice or a recommendation to buy, hold, or sell any security. You should consider whether the information is appropriate in light of your circumstances and obtain professional advice before making any investment decision. This report is intended solely for wholesale, sophisticated, or professional investors within the meaning of the Corporations Act 2001 (Cth).

Any views, probabilities, valuations, technical levels, or forecasts expressed are strictly the opinions of the authors as at the date of publication, based on publicly available information and assumptions which may change without notice. They are illustrative only and not predictive of future outcomes. Past performance is not a reliable indicator of future performance.

Directors, staff, or clients of Vitti Capital may hold positions in Audeara (ASX:AUA) or related securities at the time of publication. Such holdings may change without notice. Vitti Capital applies internal controls to manage potential conflicts of interest; however, readers should assume that conflicts may exist.

The analyst(s) responsible for preparing this research note certify that the views expressed in this report accurately reflect their personal views about Audeara (ASX:AUA) and its securities. No part of their compensation is, or will be, directly or indirectly related to the specific recommendations or views expressed herein. The analyst(s) and/or their associates may hold an interest in Audeara (ASX:AUA).