RBA Rate Cuts in 2025: Market Hopes vs Economic Reality

Aussie investors have predicted strong rate cuts in 2025. The expectation has been over 125 basis points of cuts for the year. That includes the February cut the RBA has already delivered.

That’s five cuts for the year.

Is a recession going on that we don’t know about?

The market is finally coming to its senses. We’ve seen those expectations pared back in the last couple of sessions to about 80 basis points.

That’s still four cuts for the year. A big call in a fairly stable operating environment.

The market narrative is always wrong to some degree. Sometimes it’s a lot wrong. Sometimes it’s a little bit wrong.

The expectation of five cuts this year was a lot wrong. It’s a good example of unlikely outcomes getting too heavily priced in.

Understanding how interest rates shape markets and why they can be mispriced is crucial for investors.

Interest rates ARE the markets. They drive borrowing, saving, investing, and consumption. Most retail investors don’t fully appreciate this linkage. But from interest rates, everything else flows.

They determine how we borrow, save and spend. But that’s a deep dive for another time.

So the question now is: Will reality match these dovish expectations, or are markets still overshooting?

Why Markets Expect RBA Rate Cuts: Falling Inflation and Sluggish Growth

From a macroeconomic data standpoint, the case for further RBA rate cuts has strengthened.

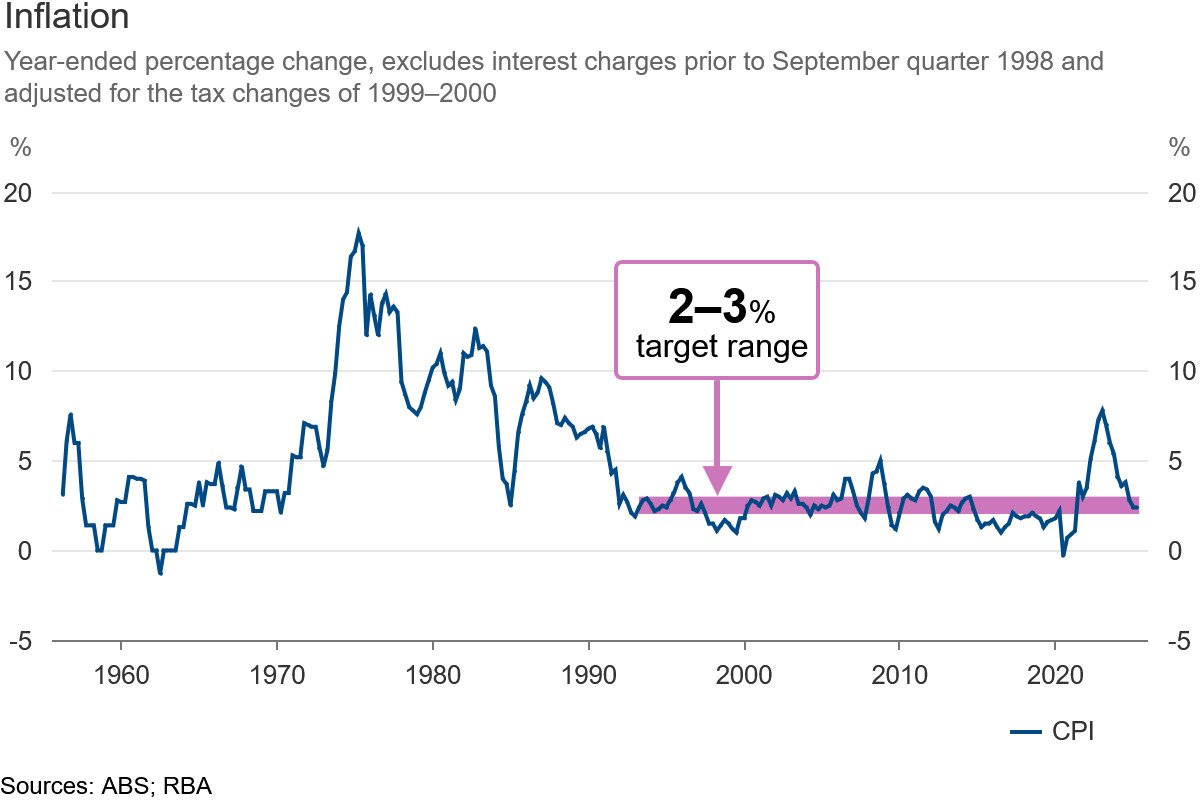

Inflation is finally under control, having returned to the RBA’s 2–3% target band for the first time in years.

In Q1 2025, the trimmed mean CPI (the RBA’s preferred core measure) dropped to 2.9% year-on-year. Headline inflation was around 2.4%. These are huge improvements from the multi-decade highs seen in 2022–2023.

With inflation pressures easing, many economists argue the RBA now has room to lower the cash rate.

At the same time, economic growth has been soft.

Retail trade volumes were flat in March, and real turnover is falling on a per-capita basis. December 2024 GDP came in at just 1.6% in nominal terms. The higher cash rate has clearly dampened private demand. Business confidence is shaky, and consumer sentiment remains subdued.

And yet, the labour market has held up well. This is important because, other than inflation, the RBA’s other core mandate is unemployment.

Unemployment edged up slightly to 4.0% in Q1 2025. A modest increase from historic lows. Wages aren’t running away. All of this suggests the current monetary policy is restrictive.

So, with inflation easing and growth cooling, the RBA can afford to reduce rates gradually.

This would support heavily indebted households, especially mortgage holders. Since 2022, monthly mortgage repayments have surged dramatically.

RBA Rate Cut Outlook: What the Central Bank Is Saying

Despite the economic case for easing, the RBA’s official stance remains cautious.

Yes, inflation is back on target. And yes, the labour market remains tight. But the central bank has not signalled urgency to deliver multiple rate cuts.

Inflation needs to fall below 2% or unemployment above 4.5% before the RBA must act with urgency.

We are not close to those numbers.

So any easing in the meantime is just the RBA peering into the future. It’s part of their job to forecast. But predicting what hasn’t happened yet is a fool’s errand. Even if it’s necessary. The RBA is like the clown distracting a raging bull from a fallen rider at the rodeo.

They look like a hero until they make one wrong move. Then they get the horns.

Consider the context of the market calling for five cuts. Trump had just taken office and started a trade war. ‘Liberation Day’, he called it. The markets were expecting a global meltdown.

But the tariffs didn’t stick. Most were stripped back to just 10%.

It was all a negotiating tactic. And we can expect many of these 10% tariffs to also come off.

Trump plays hard, sure. He once reportedly suggested nuking a hurricane. His unpredictability is a tactic, not a death wish for global capitalism.

His policies are often bluster followed by backpedalling.

There is a deliberate effort to throw people off balance and keep them guessing. It helps negotiations when people believe you might just be crazy enough to use nukes in response to a weather event. Assuming the aire of an unpredictable madman has some advantages. Not to say there aren’t downsides to this approach.

Trump changes his mind frequently. Or his words, at least.

When all the bluffing and drama are done, his actions at the end of the day aren’t so extreme. He doesn’t want to destroy the global economy. That would hurt the US too.

So, what is the most likely macro scenario for 2025? Trade relations stabilise, inflation remains on target, and the labour market stays healthy.

In that world, cutting 125 basis points looks extreme. Two or three cuts? Maybe. But five? That implies next-level Trumpism, a place not even Trump may dare to go.

Interest Rate Forecast for 2025: What Comes Next?

If the RBA delivers another 1–2 interest rate cuts this year, it would be more of a precautionary easing than a crisis response. It would serve as insurance against a weakening domestic economy, but not a reflection of collapse.

A May cut is likely .

Not because of an emergency. But because major banks are pressuring the RBA. It’s more political than economic.

Investors should take the market’s current rate forecasts with a grain of salt.

The expectation for 80 basis points of easing (three more cuts) may still be too much. A more realistic path may be one or two more cuts in 2025.